surrender green card exit tax

Estate or gift tax by resolving issues of dual-domicile. Another exit tax trigger is whether your average net annual income tax liability is over 162000.

Make Sure You Ve Got These Tax Bases Covered Before Moving To The Us The Economic Times

This is not your taxable income but your tax liability on that income.

. The surrender of US. The expatriation tax provisions apply to US. If you have a green card visa you are a resident alien for income tax purposes.

But if you are a. Year and have a green card during the taxable year your residency termination date will be the later of the date you surrender your green card or the last day you are physically present in the. When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and.

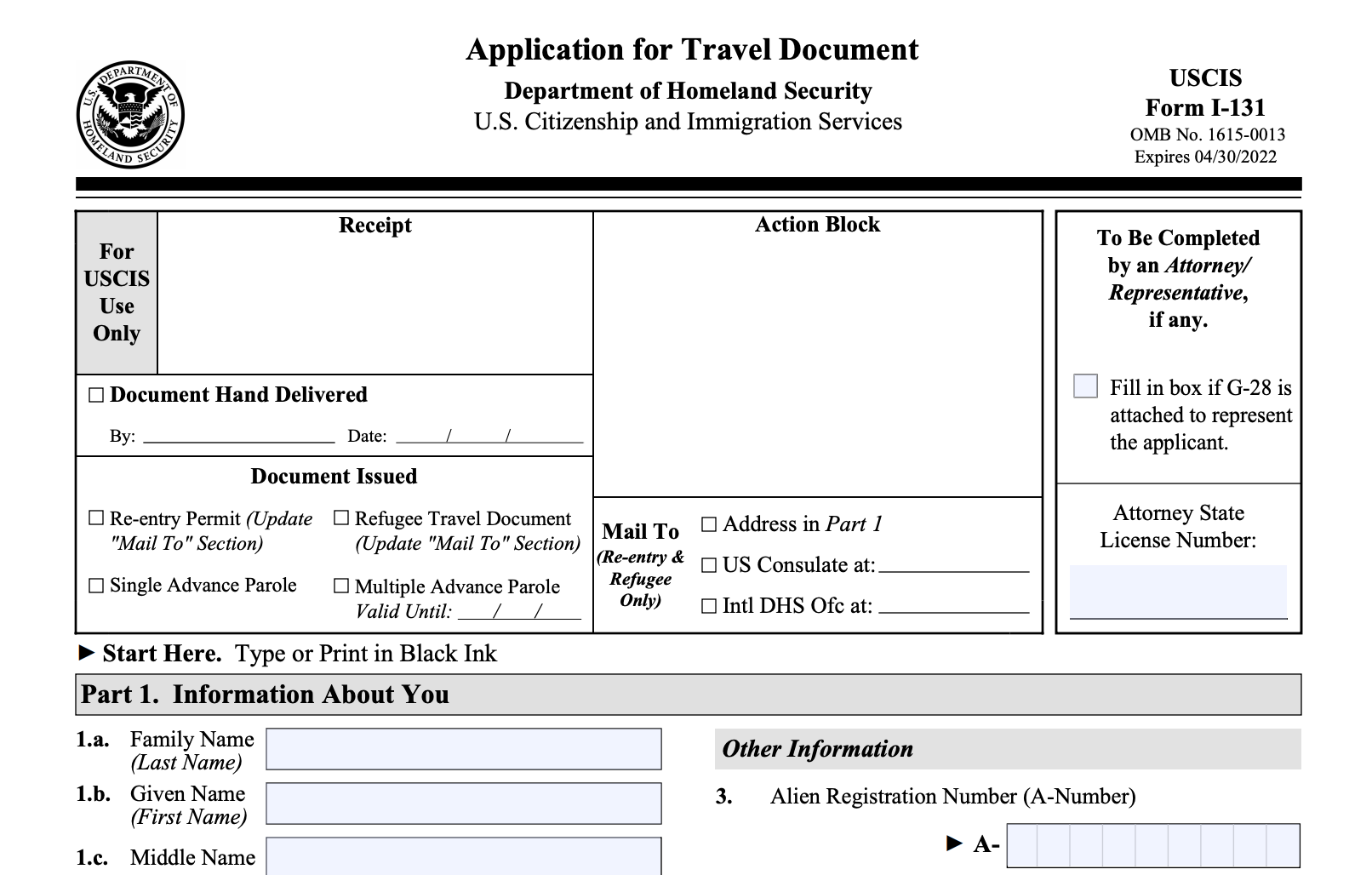

Surrender Green Card after 8 Years When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to-market and deemed distribution. To calculate any exit tax due to the US person for surrendering a Green Card an IRS Form 8854 is used. Basic tax rule for green card holders.

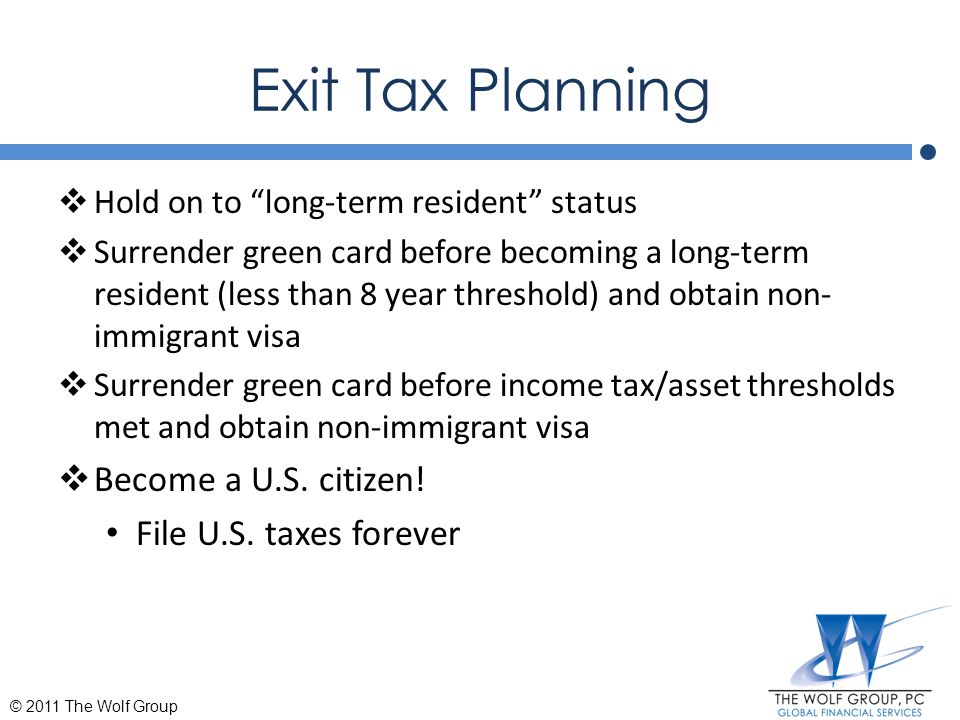

Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. Lets talk about the exit tax implications of the treaty election by this green card holder to be treated as a nonresident of the United States for income tax purposes. These treaties are designed to prevent double taxation on the transfer of the same asset which is the subject of the US.

As a Green Card GC holder you have the same tax filing requirements as US citizens. Ensure you complete a Form I-407 as the termination of your green card. Surrendering a Green Card US Tax Rules for LTRs.

This can mean that green card holders who have not formerly surrendered the green card are stuck. The exit tax is also imposed on green card holders who have held a green card for 8 out of the last 15 years referred to as long-term residents. Citizens who have relinquished their citizenship and to long-term permanent residents green card holders who have ended their US.

This can mean that green card holders who. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation. What is the departure expatriation or exit tax for US Green Card holders.

Todays blog post examines the US tax issues that surround relinquishing the green card especially at the point of entry when circumstances are not ideal for tax planning. In addition to the Exit Tax US recipients of any gift or bequest at any time in the future from the covered expatriate will be hit with a special transfer tax upon receiving that. Citizenship must be recognized by the proper immigration and tax authorities.

If you choose to give up on the American dream and surrender your Green Card. Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit tax. The consequences are simple.

Green card holders are required to adhere to US tax laws.

Re Entry Permits For Green Card Holders Explained

Income Taxes And Immigration Consequences Citizenpath

Irs Exit Tax For American Expats Expat Tax Online

Green Card Holders Staying Abroad Over 6 Months Risk Abandonment

How To Renounce A Us Green Card Gracefully Expat

15 Common Questions About Expatriation Form 8854 And The Exit Tax Answered By A Cpa O G Tax And Accounting

Renouncing Us Citizenship Expat Tax Professionals

Failure To File Irs Form 8854 After Surrendering A Green Card Or After Expatriation Htj Tax

Dale Mason Cpa Robert Len Cpa Pfs The Wolf Group Ppt Video Online Download

Us Tax Green Card Holders First Time Filers Exit Tax

Pre Immigration Tax Planning Attorneys Castro Co

Exit Tax Us After Renouncing Citizenship Americans Overseas

Green Card Exit Tax Abandonment After 8 Years

Exit Tax In The Us Everything You Need To Know If You Re Moving

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

The Tax Implications Of Renouncing Us Citizenship Or Green Cards

Never Give Up Or You Ll Be Surprised

What Every Us Green Card Holder Past And Present Needs To Know About Their Us Tax Obligation Moodys Private Client

What To Consider When Deciding To Renounce U S Citizenship For Tax Purposes The Globe And Mail